New Rules, New Opportunity

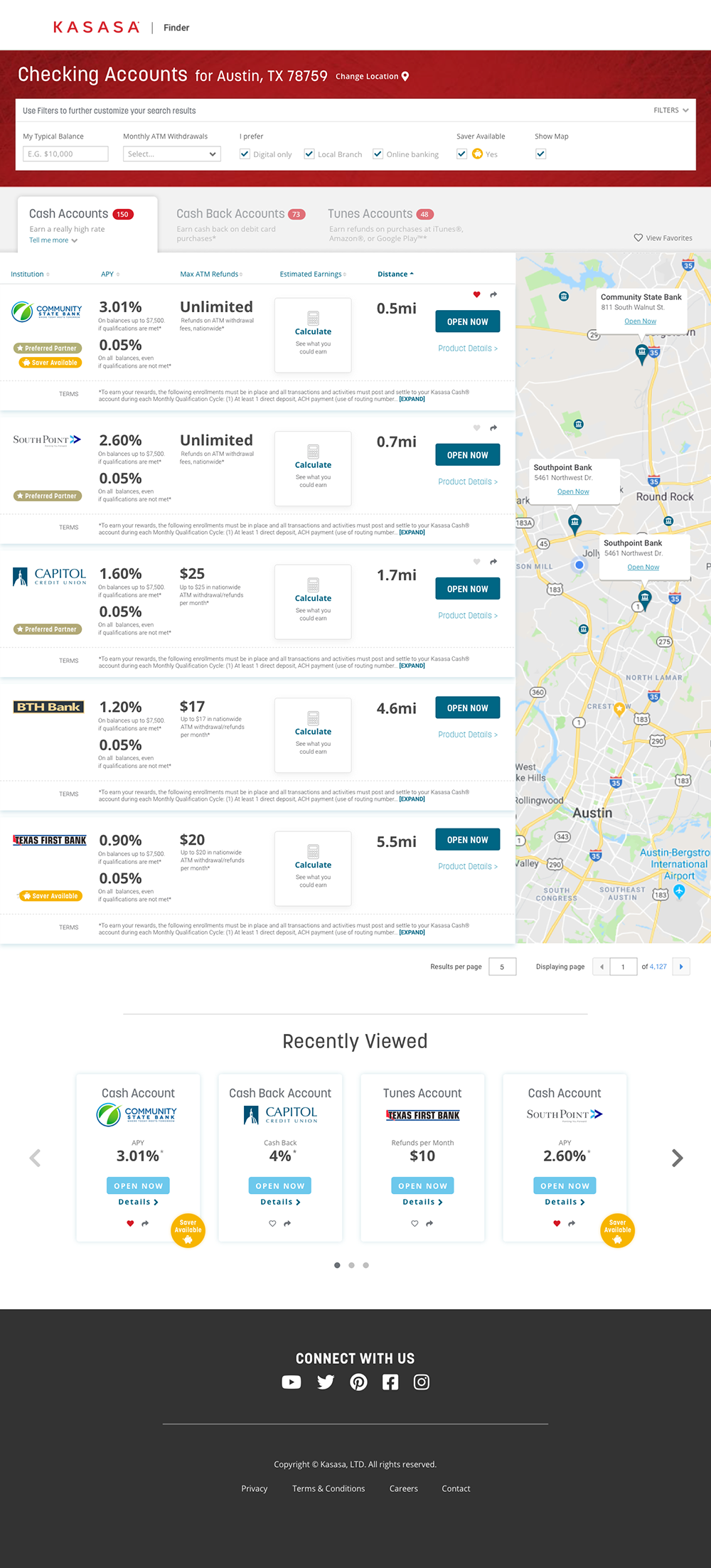

Recent changes to an intrenched federal rule that classified promoting Kasasa clients on Kasasa.com as a deposit brokering had been re-examined. It was determined that the company did not place deposits directly and acted simply as a facilitator to financial institutions. This meant the company’s ambition to create a portal site for which consumers could actively review offers from various financial institutions was now a possibility.

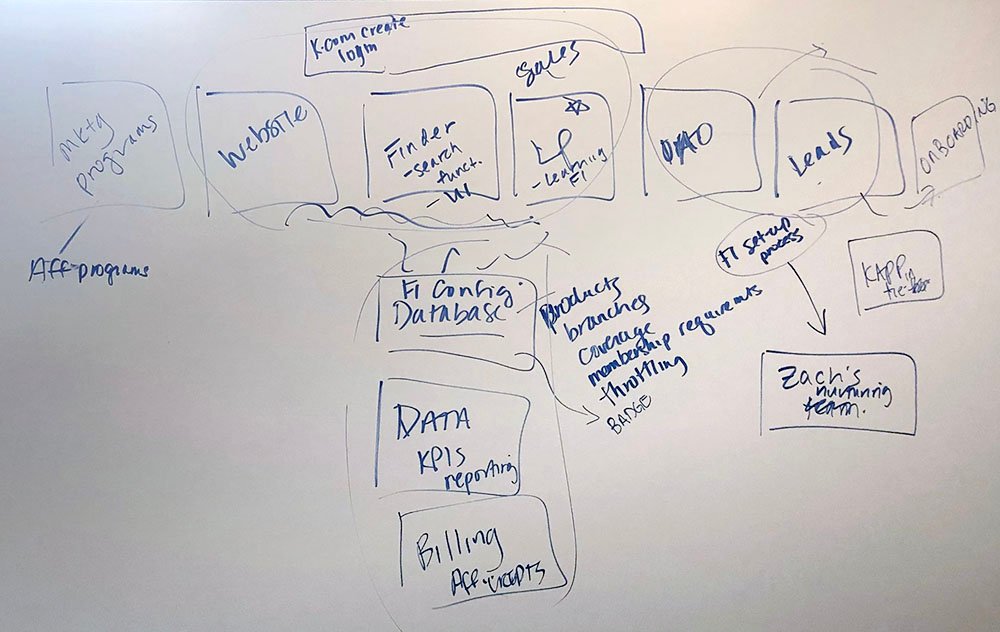

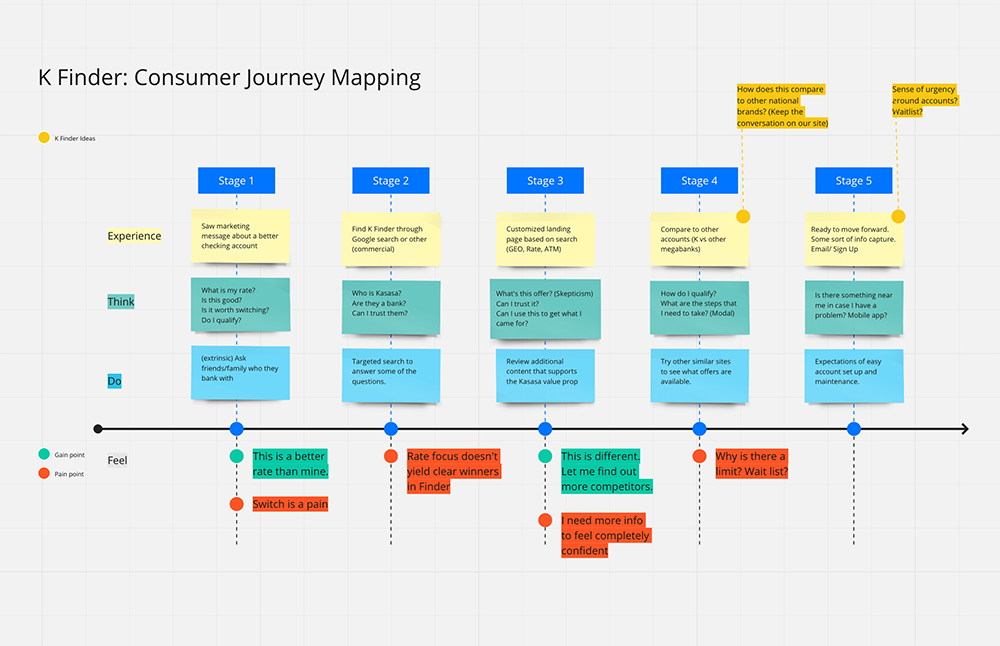

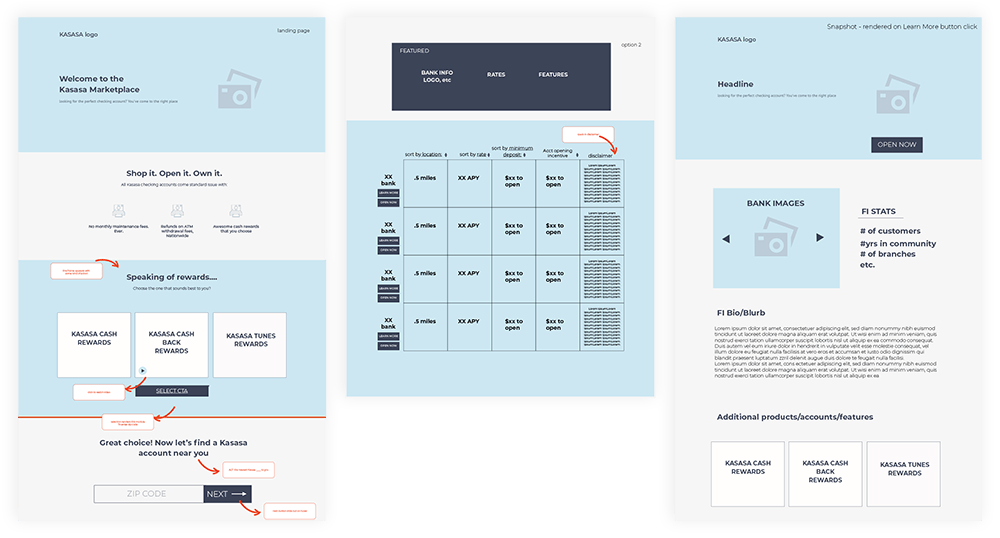

I began tackling the project by better understanding current process flows. This meant collaborating with our business stakeholders to better ascertain where the greatest opportunity lie. Not only did this require whiteboarding/working through proposed approaches, but also understanding the journey from a buyer (consumer) and seller (financial institution) perspective.