Leveraging What Works

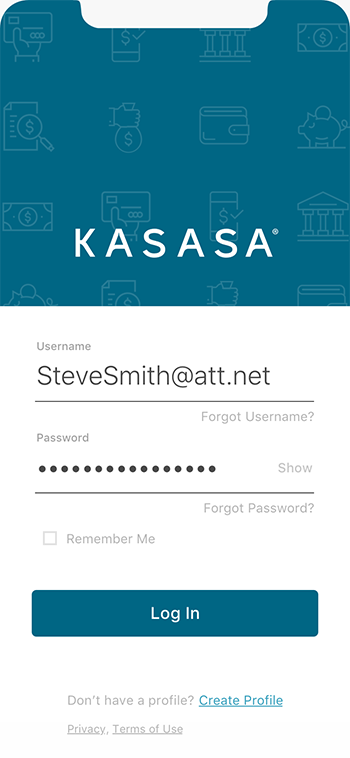

One of the biggest challenges is maintaining and building upon existing successes. With the Kasasa Mobile App, we were coming off of a Kasasa Loans application that 9 out of 10 customers preferred. Touted as the “Best of Show” during Finovate 2018, the app offered unique features that many of its competitors lacked. Understanding what consumers and financial institutions liked and didn’t like about the current product in addition to building in new tools & features meant defining both consumer and client needs up front.

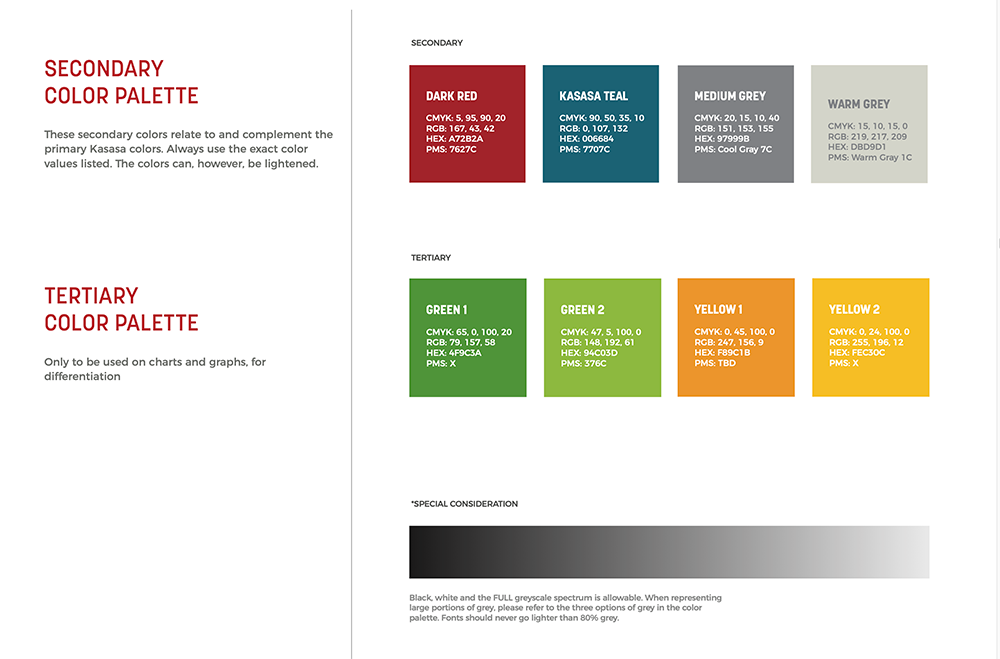

Some of our clients (banks and credit unions) felt that our “brand-first” posture within the app (Kasasa red as our primary color for example), competed with their own app. This introduced a level of friction when it came to providing the Kasasa application alongside theirs. Additionally, Kasasa had a variety of products such as Reward Checking and Savings accounts that consumers told us they wanted to be able to access within the app that weren’t currently represented.